The euro’s lucky streak will come to an end in 2018

The single currency will face a number of challenges in the year ahead, not least of which is the growing US interest rate spread

There is a well-known rule in financial theory that if you leave a drunken man in a field and come back to collect him the following day, the most probable place to find him is exactly where you left him.

The euro currency might have done a lot of random walking in the past, but two decades on the euro/dollar exchange rate is still glued to where it began life at US$1.1743 in January 1999.

For investors the euro has been like Marmite – you either love it or hate it. It has frustrated the life out of its fans and been a boon to its detractors. Its volatility swings have been wild and vicious, taking no prisoners in its extreme peaks and troughs, suffering the slings and arrows of outrageous fortune along the way. Its very existence has often been in doubt.

But the euro has had a good 2017 and even surprised on the upside, winning the sobriquet as the Comeback Kid. The euro-zone economy might have turned the corner, European politics have settled down and there has even been a palpable sense of harmony as Europe has united behind tough Brexit negotiations against Britain. The glaring question is will it last going into 2018?

The European Central Bank has done a first-rate job in pulling recovery out of the bag with a restorative mix of cheap and easy money. The ECB came to the global easing party late in the day – well after the US, UK and Japan – but it has still pulled off an economic miracle. It averted a catastrophic debt disaster over Greece and ramrodded more recovery into the euro zone than could ever been imagined a few years ago.

The euro zone is now enjoying the fruits of those labours, with economic growth notching up its fastest rate of expansion for seven years. Economic confidence is flying, unemployment is tumbling and the recovery seems reasonably broad-based. France, normally an economic laggard in Germany’s shadow, is enjoying its fastest pace of business activity for over two decades. Even Greece is back on track again.

Something positive seems to working but the real question is whether it is a sustainable turnaround. The stronger numbers look convincing at first sight, but will they stand the test of time as the impact of cheap and easy money eventually tapers and disappears. The jury is still out on that one.

Investors should not be blinded by rosy scenarios as there are still too many ghosts in the machine. The main fear is that for all the monetary steroids being pumped into recovery, the euro zone is still a zombie economy that will keel over as soon as the ECB’s special measures are withdrawn.

Germany is always going to do well, but the weaker economies remain vulnerable from a bevy of debt deflation and austerity risks. The adjustment process will extend for decades until the overload of bad loans and extremely high government debt exposures are finally run down. The euro zone is still crying out for better distribution of wealth, economic opportunity and social justice.

Despite calls for closer economic and political integration from French President Emmanuel Macron, Germany remains sceptical, not least about closer fiscal integration, fearful about the backlash from domestic voters seeing more of their taxes transferred across to poorer European nations. It may be a bridge too far considering the political winds prevailing in Germany right now.

Until the powers that be in Brussels solve the injustices of youth unemployment which is running close to 40 per cent in some southern European economies, the threat of rising populism remains ready to resurface at any time, leaving political stability and the euro’s future under a cloud.

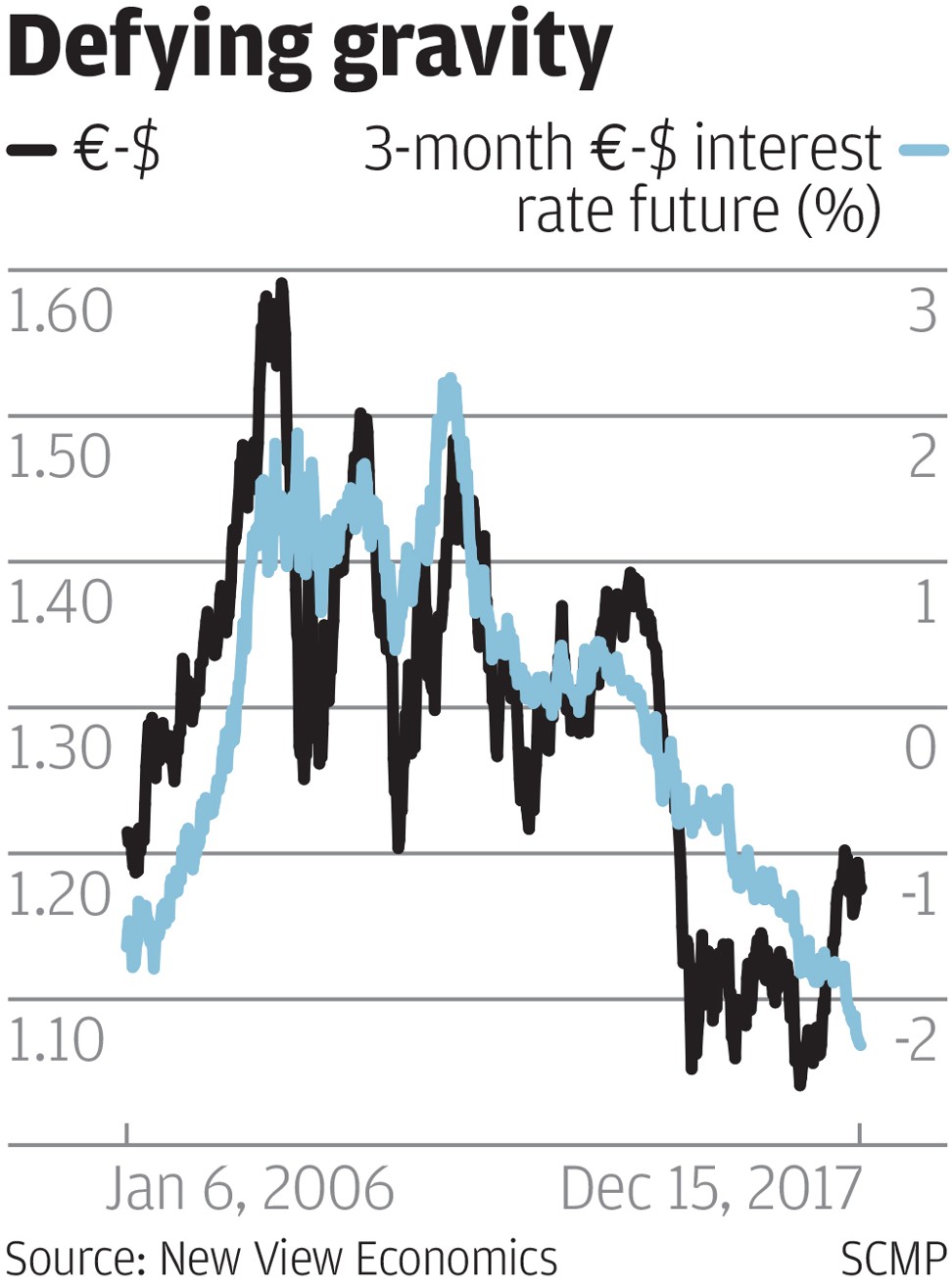

Right now the euro’s upside potential seems to have stalled, a surprise considering the currency has failed to profit more from the political uncertainties overshadowing the US dollar. The ECB’s commitment to extend super stimulus for the foreseeable future must remain a thorn in the currency’s side, especially as US interest rate spreads continue to work in the dollar’s favour.

Investors need to take great care in 2018 as the euro could be skating on thin ice as the cracks begin to spread. The crux is too much ECB easy street and not enough hard graft to save the euro in 2018.

David Brown is chief executive of New View Economics