Joe Biden plans new restrictions on US investments in China, including Hong Kong, declares ‘emergency’ on sensitive tech

- US President Joe Biden looks to restrict US venture capital, private equity stakes in Chinese firms in micro electronics, AI, quantum information technologies

- Separately, White House declares ‘national emergency’ over ‘threat of advancement’ by China in ‘sensitive technologies and products’ related to military, spying

Biden declared the move “a national emergency to deal with the threat of advancement by countries of concern in sensitive technologies and products critical to the military, intelligence, surveillance, or cyber-enabled capabilities of such countries”.

China, along with its special administrative regions of Hong Kong and Macau, was noted as the only country of concern in the emergency declaration.

China doesn’t need our money … The thing they don’t have is the know-how

The order also called for the creation of an outbound investment review mechanism “because our export controls don’t offer investments abroad that can help foreign adversaries or countries of concern to fuel indigenous development of national security technologies”, another administration official said.

“By adding outbound investment screening to our suite of national security tools, we’re enhancing US capabilities to safeguard our national security,” this official said.

The administration has planned a 45-day period of consultation, seeking input from domestic stakeholders and allied countries, to refine and clarify the rules that will be put in place to fulfil the objectives of the order.

A fact sheet distributed by the US Treasury Department, which will manage the rule-making process in conjunction with other departments and agencies, said the rules would ultimately target: “acquisition of equity interests (eg, via mergers and acquisitions, private equity, venture capital, and other arrangements); greenfield investments; joint ventures; and certain debt-financing transactions that are convertible to equity”.

To limit disruptions to ordinary capital flows between the two countries, the rules would not target “passive investments”, like holdings in publicly traded Chinese companies, a third senior official said.

Venture capital and private equity partners “connect people to experts”, the official said. “They will connect to the various companies that are in their portfolio to each other and that’s what we’re getting at.

“China doesn’t need our money; they are net capital exporters. The thing they don’t have is the know-how, and the know-how we’ve seen is often very connected into specific types of investments.

“And that isn’t necessarily seen when it comes to passive investments in the Chinese stock market.”

US weighs countering China, ‘malign actors’ with investment review board

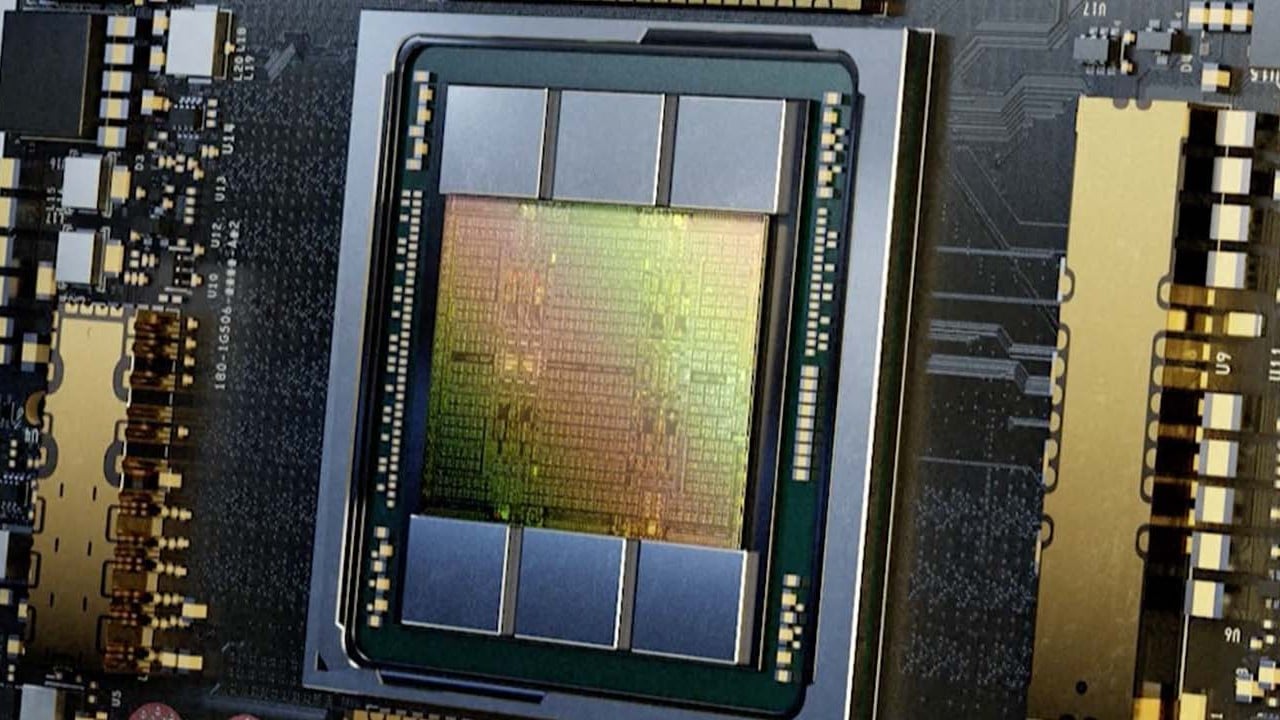

Biden’s announcement came on the first anniversary of his signing into law the Chips and Science Act.

That law, which provides about US$52 billion in incentives for companies committing to develop and produce semiconductors in the US, is meant to reduce America’s reliance on China and other markets for the key components.

Administration officials including Commerce Secretary Gina Raimondo and Treasury Secretary Janet Yellen have said the administration seeks to keep the scope of the new investment restrictions as narrow as possible to limit the damage such a move would have on the bilateral relationship.

“You don’t want the cutline to be so broad that you deny American companies revenue and China can get the products elsewhere, or China gets products from other countries, so what we’re trying to do is be narrowly defined [and] work with our allies on these chokepoint technologies,” Raimondo said last month.

One of the administration officials on Wednesday’s call with reporters said that he had spoken with Xie Feng, China’s ambassador to the US, a few weeks ago to explain the “small yard, high fence” approach to the forthcoming restrictions, referring to the narrow focus on a small number of critical technologies.

Beijing’s embassy in Washington criticised the executive order despite the diplomatic efforts aimed at pre-empting a negative reaction by China.

“The latest investment restrictions will seriously undermine the interests of Chinese and American companies and investors, hinder the normal business cooperation between the two countries and lower the confidence of the international community in the US business environment,” embassy spokesman Liu Pengyu said.

China’s chip-making tool makers face daunting task to overcome US restrictions

Analysts said Biden’s latest move would not immediately imperil the ability of China’s tech sector to raise money, but could become more significant as the Treasury’s rule-making evolves.

Taylor Loeb, an analyst with research firm Trivium China, called it “basically an order to make an order”, adding that he was surprised at “how unspecific it is”.

“American investment, especially American PE, VC investment into … Chinese hi-tech sectors, is not nothing, but compared to global investment and domestic investment into the high tech sector, it’s very, very minimal,” he said.

China still draws billions of dollars in US investment each year, which many of Washington’s critics of Beijing have spotlighted as potentially undermining American interests. But the upwards trajectory has moderated in recent years.

Risk consultancy Rhodium Group estimated that US direct investments in China had levelled off from an average of US$14 billion a year from 2005 to 2018 to an average of US$10 billion a year from 2018 to now.

AI, superconductor experts joined Chinese summer leadership retreat in Beidaihe

Rhodium’s data on US venture capital in China showed investment at a 10-year low last year at US$1.3 billion, down from the peak of US$14.4 billion in 2018.

Paul Triolo, senior vice-president at Albright Stonebridge Group, a business strategy firm, said the details of Biden’s executive order represented just a starting point. More specifically, he called it “a starter kit” of a longer process.

The announcement was a “sort of a watershed and an attempt to corral this issue of outbound investment”.

“There’s some major areas like AI, where there’s an acknowledgement that AI is such a broad category that they’re going to try to be more careful in how they scope,” said Triolo, who estimated that the rules will not take effect at the end of the first quarter in 2023 at the earliest.

The restrictions come amid aggressive rhetoric and legislative action in Congress from lawmakers in both parties seeking to curtail America’s economic integration with China. These include bills and other actions aimed at cutting investments in Chinese companies.

In May, a bipartisan bill was introduced in the Senate that would prevent the retirement plan for federal employees from including stakes in Chinese companies, the latest in a series of laws and executive orders aimed at restricting the ability of US entities to fund technologies that could harm American national security.

Why the party’s over for Chinese venture capitalists in Silicon Valley

Rubio issued a statement immediately after the White House announcements on Wednesday, calling the moves “almost laughable” and vowing to introduce legislation that would establish a different outbound investment review process.

Biden’s narrowly tailored proposal, the senator said, “is riddled with loopholes, explicitly ignores the dual-use nature of important technologies, and fails to include industries China’s government deems critical.

“I will introduce legislation in September to create an outbound investment process that actually protects American economic and national security interests,” Rubio added.

Companies prohibited in the TSPA include not only those headquartered in one of the four targeted countries or listed on exchanges in them, but also those firms deriving more than half their revenues within the countries.

Loeb of Trivium China said congressional pressure would likely lead to other stricter regulations.

“There are definitely people in Congress who are going to look at this and say this is so weak,” he said. “Something like this is kind of step one in a long process of future orders. I look at it like capital controls are like the new frontier of US-China decoupling.”