China, Saudi Arabia enter ‘new stage’ of financial cooperation as state-owned bank opens Riyadh branch

- Bank of China (BOC) opened its branch in Riyadh on Tuesday, more than two years after being given approval by the Saudi Arabian government

- China’s ambassador to the kingdom, Chen Weiqing, pointed to the financial, investment and geographical advantages of Saudi Arabia

China’s most internationalised state bank on Tuesday opened its first branch in Saudi Arabia in a move to expand the use of yuan amid a growing number of economic deals between the two countries.

Bank of China (BOC), one of China’s four biggest state-owned banks, opened its branch in Riyadh, the capital city of the oil-rich Middle Eastern country, more than two years after being given approval by the Saudi Arabian government.

The branch has more than 20 staff, with a majority hired locally – a condition requested by local authorities, a person with understanding of the matter told the Post.

It is the second Chinese bank to open a branch in Saudi Arabia after the Industrial and Commercial Bank of China (ICBC) opened its first branch in Riyadh in 2015. ICBC also opened a branch in the Saudi city of Jeddah in May.

It also shows that China highly recognises the financial regulations, investment environment, and geographical advantages of Saudi Arabia

China’s ambassador to Saudi Arabia, Chen Weiqing, said the opening of the branch was a result of positive developments in the bilateral relations between the two countries, and “new stage” of financial cooperation.

“It also shows that China highly recognises the financial regulations, investment environment, and geographical advantages of Saudi Arabia,” Chen said, as he attended the opening ceremony with Bank of China president Liu Jin.

Saudi Central Bank governor Ayman al-Sayari and Saudi Arabia’s deputy investment minister, Saleh Ali Khabti, also attended the opening ceremony along with 250 guests, according to a BOC statement.

The Saudi-listed ACWA Power, Saudi Arabia’s Ministry of Investment, Ajlan & Bros Holding Group and Zhejiang Rongsheng Holding Group signed memorandums of understanding involving “internationalising” the yuan and green financing with BOC during the opening ceremony, the statement added.

A piece of cake? China-Saudi Arabia embrace ties, but it’s not all sweet success

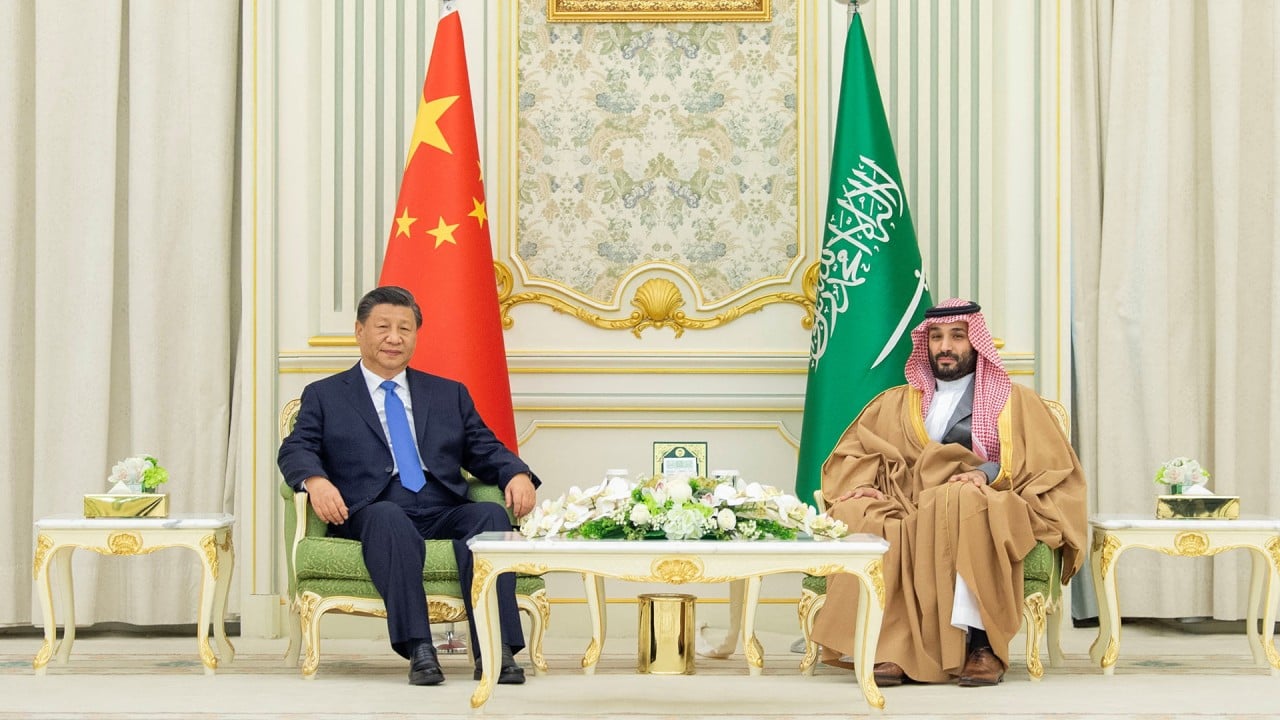

During the trip at the end of last year, Xi pledged to work towards widening the use of yuan in oil and gas trade in the region, amid a push to establish the currency internationally and weaken the US dollar’s grip on world trade.

Saudi Arabia is China’s largest source of crude oil imports, with 87.5 million metric tonnes (641 million barrels) shipped in 2022.

Amid efforts by state banks to tap potential in the Middle East, BOC’s new branch has been licensed to provide basic commercial banking services to individual consumers and small- to medium-sized businesses, ranging from deposit accounts and loans to mortgages and yuan transactions.

At the weekend, BOC president Liu also met Khaled Mohamed Salem Balama Al Tameemi, the governor of the central bank of the United Arab Emirates, to court more support for its yuan clearing in the region and potential cooperation with the nation’s sovereign wealth funds.

In an interview with local media in June, BOC said the new branch aimed to offer the yuan to the wider Middle East region to assist commercial and financial trade between China, Saudi Arabia and beyond.

“As there are many Chinese companies entering the market in the region, being able to trade and make financial transactions using [the yuan] would encourage Chinese companies to invest in the area,” an unnamed BOC spokesman responsible for the project was quoted as having said.

The Saudi Arabian government first agreed to allow BOC to open its branch in January 2020. At the time, Saudi Arabia had only 14 foreign banks, including ICBC.

Beyond crude oil, is China the ‘ideal partner’ for Middle East development?

BOC also has existing branches in Abu Dhabi and Dubai in the UAE, as well as Bahrain, Turkey and Qatar.

The bank has also been in discussion with local counterparts to offer panda bonds – yuan-denominated bonds sold by overseas entities in China’s onshore bond market to raise investments in China.

A number of other banking sector collaborations have also been announced this year.

In March, the Export-Import Bank of China announced a first loan cooperation with Saudi National Bank, Saudi Arabia’s largest bank, in yuan.

Hong Kong has also been named as a major hub for financial cooperation between China and Saudi Arabia.