Hong Kong ‘back in business’, finance chief Paul Chan tells fintech event as government proposes raft of measures to promote virtual-assets industry

- FinTech Week is the first of a series of mega events Hong Kong is hosting to mark its return after almost three years of Covid-related isolation

- Spokesman for financial secretary says Paul Chan has tested negative for coronavirus and set to return to Hong Kong on Tuesday afternoon

Hong Kong has launched the first of a series of international events to tell the world that it is “back in business”, with the government on Monday proposing a raft of measures to promote the virtual-assets industry.

In a pre-recorded video for the opening of FinTech Week, Financial Secretary Paul Chan Mo-po noted that Hong Kong was now home to more than 800 financial technology enterprises from 180 five years ago, with growth powered by the city’s strengths such as an open market, a rigorous regulatory regime, the rule of law and the “one country, two systems” governing principle.

Ahead of the forum, the government also issued a policy statement on the development of virtual assets in Hong Kong, saying it would launch a number of pilot projects to test the technological benefits and their further application in the financial markets.

“We want to make our policy stance clear to global markets, to demonstrate our determination to explore financial innovation together with the global, virtual-assets community,” Chan told participants of FinTech Week.

“The digital transformation of our financial services sector is a central priority.”

FinTech Week is the first of a series of high-profile international events Hong Kong is hosting to announce its comeback after nearly three years of cloistered existence under Covid-19 curbs following the political turmoil of 2019.

Next up is the Global Financial Leaders’ Investment Summit, which will hold its first panel discussion on Wednesday, followed by the Hong Kong Sevens rugby competition, which kicks off on Friday. The popular tournament was last held in 2019 and has been delayed five times over the past two years because of the pandemic.

With the No 3 typhoon warning signal in force on Monday, organisers said they had contingency plans ready to ensure the summit would proceed in case the weather worsened.

Week of large-scale events shows Hong Kong is ‘open for business’: treasury chief

Chan was forced to deliver his opening speech through a pre-recorded video after he contracted Covid-19 while on an investment promotion tour of the Middle East last week, although he was scheduled to return to the city on Tuesday afternoon after testing negative, according to his spokesman.

The minister told the attendees gathered at the Hong Kong Convention and Exhibition Centre that FinTech Week was a “memorable moment for Hong Kong in a great many ways”.

“In a great many ways, we’re telling the world that we’re back,” he said. “Back in business, back in the business and pleasure of welcoming you to Hong Kong.”

Authorities had also worked together with their mainland Chinese counterparts to help fintech companies carry out trials of cross-border initiatives, the minister said.

A new online system connecting local fintech companies to users, partners and investors in markets on the mainland, Southeast Asia and beyond, would be launched by the end of this year, Chan vowed.

Speaking on the sidelines of the conference, Hong Kong Monetary Authority (HKMA) chief executive Eddie Yue Wai-man said the coming banking summit would show the dozens of industry leaders slated to take part that the city remained vibrant and dynamic.

“So that after they’ve come to the city, when they get back, they will have the clear impression that, ‘Hey, Hong Kong is back’, Hong Kong is open for business, and Hong Kong remains the premier international financial centre in Asia,” Yue said, adding “all” of the city’s factors for success remained intact after enduring nearly three years of the pandemic.

Secretary for Financial services and the Treasury Christopher Hui Ching-yu said the city should have confidence in its unique strengths when asked whether its finance industry was capable of competing with Singapore, which is running its FinTech Festival from Wednesday to Thursday.

“Our advantages are obvious: we have the motherland [supporting us] … We are also attractive to international talented professionals, who come to Hong Kong as we are the gateway for them to enter the mainland market,” he said, also speaking from the sidelines.

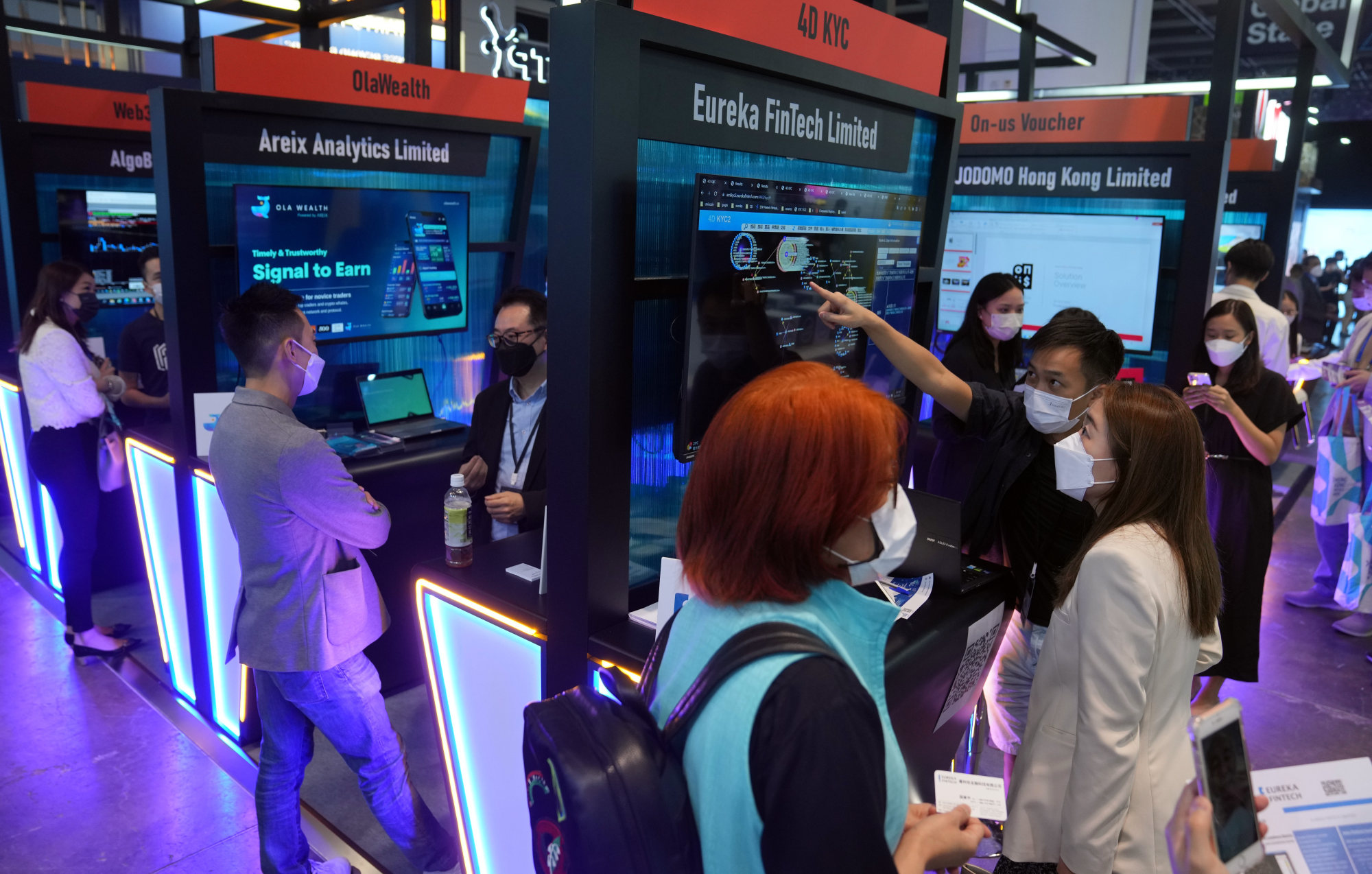

The five-day event is predicted to draw 20,000 attendees, with 12,000 taking part in the two-day main conference. More than 400 sponsors and exhibitors had also signed on, authorities have said.

The banking summit, organised by the HKMA, is expected to be attended by about 200 global financial leaders from more than 100 major institutions, including banks, securities firms, private equity and venture capital firms.

‘Appropriate’ plans for Hong Kong banker summit if needed after Chan Covid case

More than 40 of the global institutions will be represented by group chairmen or CEOs, including BlackRock’s president Rob Kapito, HSBC chief executive Noel Quinn, JPMorgan Chase & Co president Daniel Pinto, Morgan Stanley chairman James Gorman and Standard Chartered chief executive Bill Winters.

But Barclays group CEO C. S. Venkatakrishnan bowed out of the conference after changing his plans to visit the region this week, while Citigroup’s CEO Jane Fraser and Blackstone president John Gray also pulled out after contracting Covid-19.

A spokesman for the HKMA said it was updating the summit’s programme to reflect the replacement of a speakers.

Referring to the approaching storm, he said: “Hong Kong is well prepared for the potentially difficult weather and the summit is no different. The summit and its important conversations will proceed as planned. We invite guests and members of the media to attend as planned, as long as it is safe for them to do so.”

Health authorities on Monday reported 4,766 coronavirus cases, of which 466 were imported and 12 more related deaths. The daily number has not fallen below the 5,000 mark since October 18. The city’s Covid-19 tally stands at 1,918,708 cases and 10,397 related fatalities.